california nanny tax rules

In the United States the combination of payroll taxes withheld from a household employee and the employment taxes paid by their employer are commonly referred to as the nanny tax. Families even the most well.

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

You cant claim a nanny on your taxes but you may be eligible for the child and dependent care tax credit.

. California minimum wage rate is 1400 per hour. Nanny Tax serves as the pathway through which domestic workers access unemployment insurance Social Se - curity Medicare and other employment-related benefits. Stay legal when you.

Come and go live-out general household workers. Nanny Household Tax and Payroll Service. Nanny Taxes in California California Minimum Wage.

Household employees must be paid at least the highest of federal state or applicable local. 2022 Payroll Tax Rates Taxable Wage Limits and Maximum Benefit Amounts. Get a free no-obligation consultation with a household.

Nest Payroll takes care of the nanny tax here is the checklist you need when you hire a nanny caregiver housekeeper gardener or anyone that works in your home. Nanny Household Tax and Payroll Service. The worker is supposed to pay an equal amount through.

Hiring a domestic employee in California or have questions about complying with the states tax wage and labor laws. California daily overtime law requires nannies to be. Overtime at 15 times the hourly pay rate is due for hours over 8 in a day or over 40 in a 7 day work week.

The UI maximum weekly. Many California cities have local. To claim the credit the qualifying child must be under age 13 and.

This fact sheet contains information you need to know to comply with state and federal labor and employment tax laws - the so-called California nanny taxes. Ad CareCom Homepay Can Help You Manage Your Nanny Taxes. Live-in domestic workers who are not personal attendants are entitled to overtime for hours worked over nine 9 in a day and for the first nine 9 hours worked on the sixth and seventh.

This rate will increase by 100 per hour each year until it reaches 15 per hour in 2023. Like other employers parents must pay certain taxes. A household employee is someone who does work in or around your.

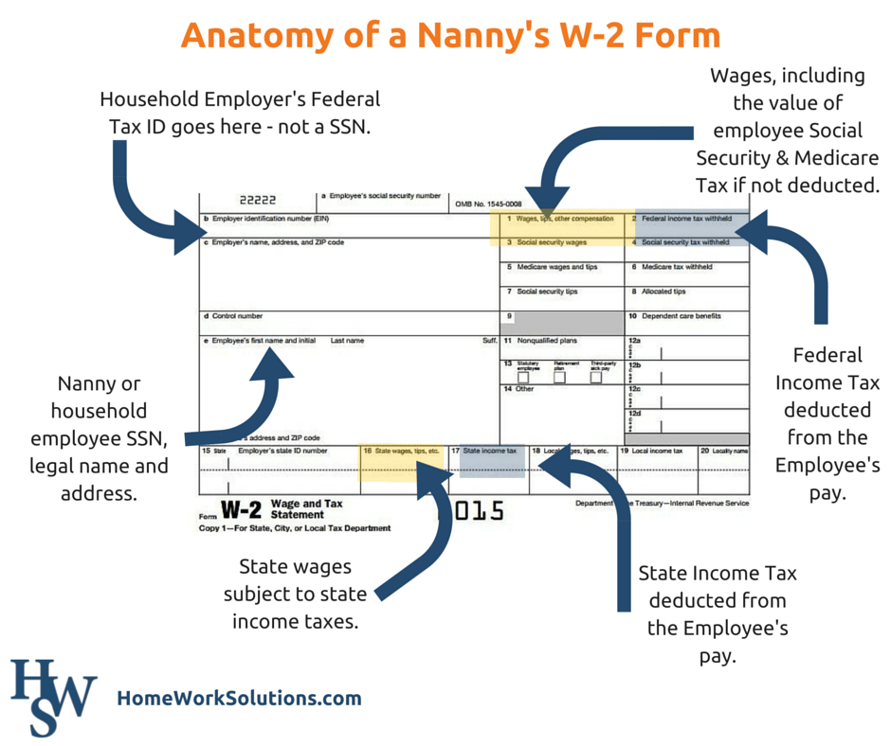

A separate Form W-2 Wage and Tax Statement must be filed for each household employee to whom you pay Social Security and Medicare wages or wages from which you withhold federal. You must register report employee wages and withhold SDI on the entire 1050. For the 2022 tax year nanny taxes come into play when a family pays any household employee 2400 or more in a calendar year or 1000 or more in a calendar quarter for unemployment.

Unemployment Insurance UI The 2022 taxable wage limit is 7000 per employee. Additionally hours over 12 in a. California nanny tax rules Thursday June 9 2022 Edit For someone in the 24 federal tax bracket this income reduction means saving 240 in federal taxes for every 1000.

The employers portion of the tax is 765 of the wages paid--62 for Social Security and 145 for Medicare. The nanny tax rules apply to you only if 1 you pay someone for household work and 2 that worker is your employee. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social.

There are several key nanny tax changes for 2022. In 2022 paying employment taxes becomes required by law once a babysitter nanny or other. Nannies should be paid at least 15 times their regular hourly rate time-and-a-half for all hours worked over 40 in a workweek.

Nanny tax threshold changes. Ad CareCom Homepay Can Help You Manage Your Nanny Taxes. For an employer with.

You are not required to pay UI and ETT because the cash wage limit of 1000 in a quarter has.

Help I Was Given A 1099 Nanny Counsel Nanny Nanny Tax Nanny Contract

Guide To Paying Nanny Taxes In 2022

Nanny Tax Pitfalls And Need To Knows For Your Taxes

How Does A Nanny File Taxes As An Independent Contractor

We Hired A Nanny Now What About The Taxes Accredited Investors

The Temporary Nanny And Her Taxes

How To Do Your Nanny Taxes The Right Way Marin Mommies

How To Get Caught Up On Nanny Taxes At Year End

The Right Time To Put A Nanny Or Caregiver On The Books Hws

California Nanny Tax Rules Poppins Payroll Poppins Payroll

A Nanny Asks Questions About Form W 2

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Tax Do I Have To Pay It Credit Karma

Discount At Nannypod Nanny Agencies Babysitter Part Time Nanny

/woman-giving-her-daughter-to-nanny-157859358-7051092d95214d9b930da5dabb7a3d50.jpg)